When speaking to the organisers I thought it would be a good idea to present at the

Mobile Roaming Conference 2013 on the impact of the EC Roaming regulations 2014 from, you know, the customers' perspective. It was a good idea and the presentation was received very well... however writing it was a lot more painful than the usual presentation!

|

| It was only right to add the cover after I had made it look so nice... |

So the premise of the presentation was to look at the user experience (UX) of customers while roaming in the European Union and how this may change with the wider EC roaming regulations of 2014, which will of course affect MVNOs. Virtuser is pretty well placed to speak about this, as we were there for the first round of regulations, requiring last minute WAP pages and SMS gateway solutions, and we have helped numerous MVNOs comply with regulation with advice of charge, etc.

|

| Apple was not the first App Store, by far, nor the first to do apps, but the won with great UX |

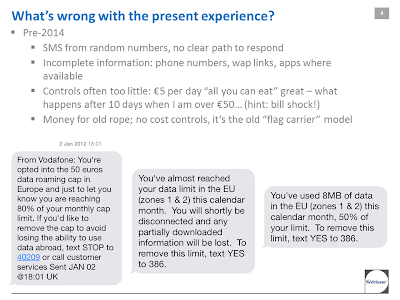

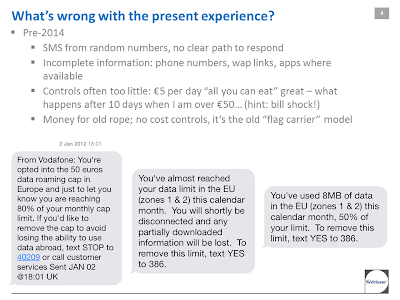

So what is the customer experience at present of not just the roaming regulations, but also just roaming... well its not a good one and its very, how shall we say, pre-iPhone, in fact pre WAP: when did you ever have a great text based customer experience?

|

| The present Roaming Regulation experience is pretty dire and text only mostly |

Most roaming experiences start with an overly edited text message, with no number to call customer service for free as we are supposed (come on, we know standard customer care calls abroad are not free, right?), the SMS service is most likely completely disconnected from any core systems or customer care tool and is the main reason why there are so many dormant roamers: when did a text based UX last convince you to buy something?

|

| The roaming experience gets worse, what happens when you go over your limit? |

Then what happens when you go over the €50 limit? the €5 per day all inclusive plans are brilliant, but after 10 days what do I do... well you opt out and one operator was good to their word (above) another shall remain nameless and rubbed their hands together and delivered me a huge dose of bill shock. So I had 10 days of roaming regulation induced sanity, the rest of the time I was back in the dark ages.

|

| And the prize for the best Roaming Regulations advice of charge message is.... |

Vodafone UK has, as far as I am concerned, the best roaming track record post the roaming regulations, however what went on in the office the day they decided this message was the way forward? and this is the reduced version as I culd only fit four screenshots in...

|

| Its not just the regulated messages that are a poor customer experience |

After upgrading my iPhone on Vodafone 3 or 4 times, once it decided I needed to change my romaining plan of the last 4 or 5 years... you know, just to shake things up a little: So I arrive and get a message saying I will be charged about 120 times my usual national rate for data as I was no longer using its roaming tariff - great, I am in a taxi, trying not to be taken the scenic route and make a meeting and I have to spend 30 minutes on the phone to my Operator (10 of which were on hold). I finally get it sorted and two hours later get a message, but when did the new tariff set in? was my call that I made a note to check on my bill that was free really free (I never got round to it, but suspect I know the answer).

Then there is the wonderful experience, particular to Voda UK, where on an iPhone, a person in your contacts list calls you and their number appears, you have them saved in your phone, as you do with all your numbers, with the +44 international code... yet you go to call them back, and because voda has delivered the call without the international code you get an error code and a text saying you need to put "00" in front of the number... worse is, I have spoken to a few people in Voda about this and they all go "oh, yes, that..." with a look of "who is going to take the next year of their life to fix that and probably not succeed or be thanked for it anyway" ...and I pay a premium for this type of service?

|

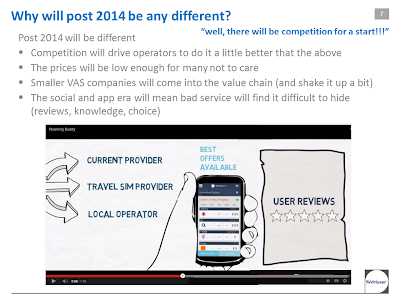

| post 2014 will be different as it will introduce competition and "it will do" will no longer be good enough |

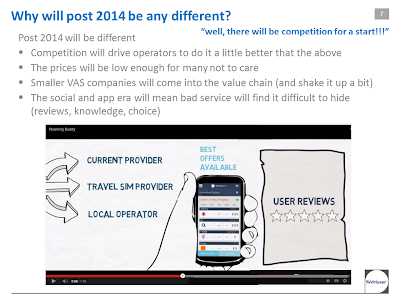

So why will 2014 be any different when the second wave of EC roaming Legislation comes in? well, for a start, it will introduce competition. Operators do not typically like this, nobody in business really does, but we accept it as we know it is what get's you out of bed in the morning to drive progress. This progress is also important, as it will mean an app driven, internet based experience with all that that brings: real time knowledge, social interaction and real time reviews and ratings: it will be as close to a proper experience as we can get.and will bring roaming from pre app store to smartphone experience in one swoop... finally!

|

| post 2014 with bring a) competition, but moreover b) an smartfone, interactive web and app based CX |

It is this competition, as counterintuitive as it may seem, that will drive the 70% of dormant users to adopt roaming. Just as with national data and widespread mobile usage of all services (voice text and data) it was not just lower rates that drove wide spread adoption: it was competition: people did not message universally until whatsapp and imessage. Yes the operators lost a base a small % of their base who were uber texters, but they gained a complete base of data users who needed text as a fall back and the total volume of texts increased. The same with data, many people needed the comfort of their home wifi and hotspots to make the jump to a data tariff.

|

| So who will win? the counterintuitive answer is everybody, as this will drive out the 70% dormant roamers |

TBH many roamers will stay with the even lower price drop of their native operator, but if they go over their €50 limit, or their boss/client suddenly decided they need to rewrite a presentation with videos in it (been there) they have mobile options that do not mean finding a cafe with internet.

I spoke to a lot of people about this, in my own mini focus group and took some great phrases you see in the word cloud from industry insiders, regulators and users: like:

- It will take a while for people to gain faith in roaming regulations, like a whole yearly cycle of travelling.

- Value is important. you do not want to pay €5 or even €2 every day, but you will happily pay €10 just for data the day your boss needed that presentation yesterday

- legacy billing is no longer an excuse, in fact its the excuse we all got bored of and drove this regulation in the first place!

- Technology challenges need to be overcome, like even UX, how do you go from one app (your native host operator) to the LBO app and configs and back again. It's bound to break at first!

- Competition is key, its no longer enough to ignore this, or your revenues will reflect this

- Roaming is still a huge revenue by EBITDA % but will need a small investment in UX to grow

But these can be overcome, and whether you an an MNO or MVNO I have helped both through this before... so get in touch if you want to discuss apps and OTA settings and SMS gateways!

|

| Thankyou! |

Follow

@MVNO_ on twitter or

facebook/mvnos or Google+

MVNO page