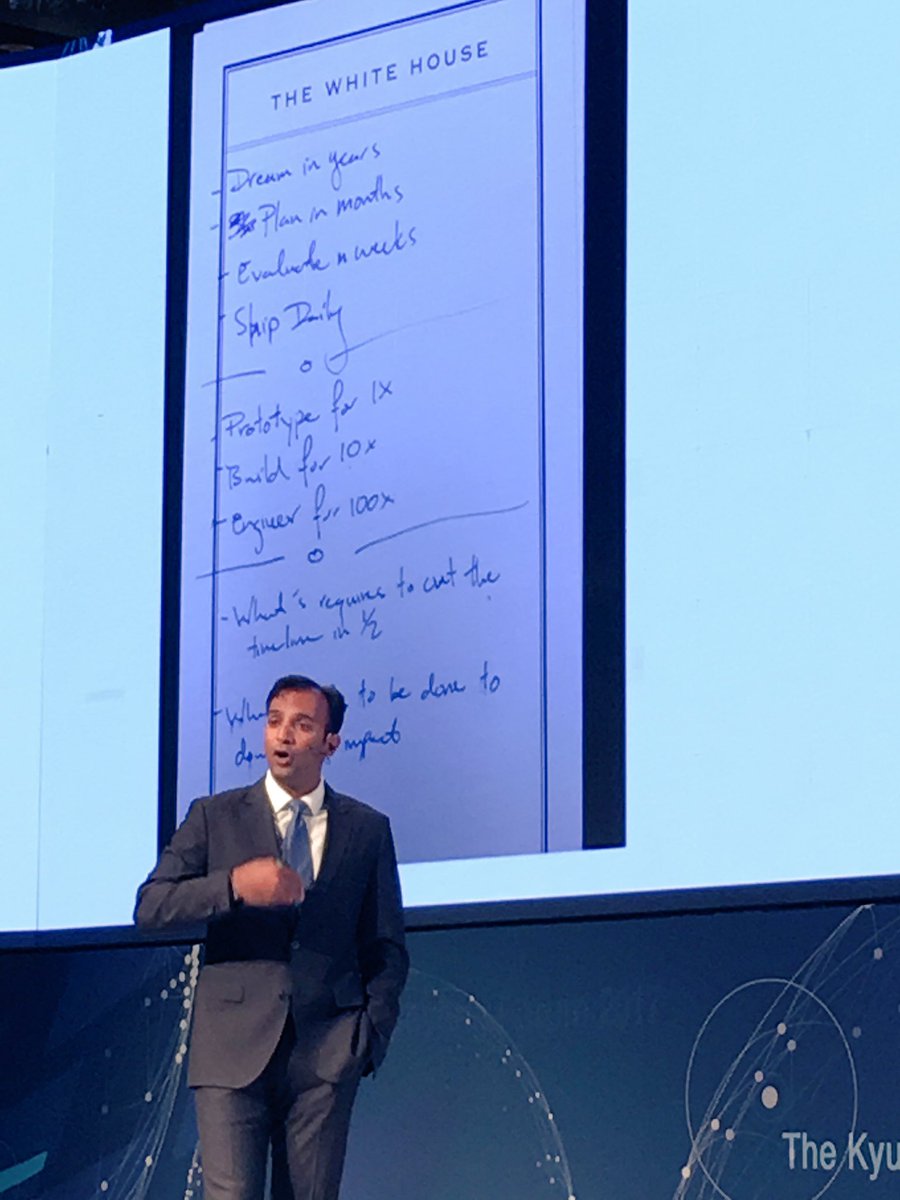

Being true to the Minimum Viable Product in MVNO; shipping daily, Evaluating weekly, planning monthly

This Image from a former Chief Data Scientist of the white house came up in my Linkedin stream and serves pretty much as a catalyst to an article that has been in draft for a while on this blog, so here goes as it is very, very relevant to the MVNO model, and here is a link to the post plus another I could find while checking superficially that it was not fake news ... https://goo.gl/images/v7neVw

|

| These ideals are ones for MVNOs to very much live by |

Ship Daily: The importance of the mantra: Ship Daily in MVNO, MVNE, MVNA, MVNx

Possibly the most important bullet on this list is ship daily, and its the one I struggled most with in my early days: I could never understand why investors and potential customers were so wrapped up in a handful of growing sales, but now 20+ years on I get it and cannot understand why some customers so overlook getting a handful of sales and growing it, especially those looking for investment.. Shipping daily, even if its just the handful of SIMs like in the next bullets, means you are getting feedback, you are learning customer patterns, you are leaning how to optimise your service, your time and your processes and what is possible based on practise, not theory. In theory these two are the same, but as we all know in practice they are very, very different. If we then jump to below, a generic me too non differentiated product will not grow, it will stop and start.In the end customers are also like investors: its very easy to sell a service to someone who's friend or colleague already has it. It's very hard to make your first sale without "daily shipments".

Evaluate weekly: the importance of evaluating constantly and MVNO, MVNE, MVNA or MVNx

If all the daily shipments want a refund, it's easier to manage, adapt and refine with daily shipments than suddenly having hundreds or thousands of refund requests. Weekly evaluation is not always easy: you need a real-time platform (realtime billing, realtime CMS, realtime reporting) to do it properly, but at its most superficial level you need to be editing your products page weekly, looking at the data, looking at your CRM (salesforce etc) or just a sales spreadsheet and looking back at what worked and what needed improvement. Honestly of course! And this is important; people who shy away from this lack either the confidence or experience to be honest and handle failure maturely and learn from it: without this no MVNO will continue to grow or scale.Starting and keeping true to the MVP is key to success in mobile wholesale; If you are not evaluating weekly what is being shipped daily what you have is a minimum, if you are lucky its a product, but it's invariably not a viable product.

Plan MVNOs in Months

Many MVNOs and MVNEs are truly woeful at planning and spend their time drifting between daily emergencies, fads, whims and red herrings. Alternatively, others have the worlds biggest project plan and spend their days chasing tasks rather than the yearly dream or the daily sales: the key is i the middle and resides in Monthly planning; what is this and next months target, are we on track (from daily sales and weekly evaluations... ) and most important the dependencies. You have to be able to run before you can walk: if you have not sold 1, 10, 100 or 1,000 SIMs; is that huge deal of 1,000, 10,000 or 100,000 SIMs really going to happen? The answer is "highly unlikely". Even if that big deal does happen, how likely is it to fall apart i the process if you have not cut your teeth on 1, 10, 100 sales: the answer is "highly likely".Get a spreadsheet, make a list, number them, list any dependencies, and most importantly who is going to do each task and by when.

|

| Its always refreshing to get an agenda like this when someone is speaking |

Dream MVNO in years

Do we need to say Dream in years? Sadly we do; even shipping daily, evaluating weekly and planning monthly - mobile businesses take years, if you don't stick to the above mantra mobile businesses invariably never make it as nobody has decades!I will cover the other parts in an upcoming post / add here so don't forget to follow however you prefer on twitter, linkedin, facebook etc on the top right social icons.